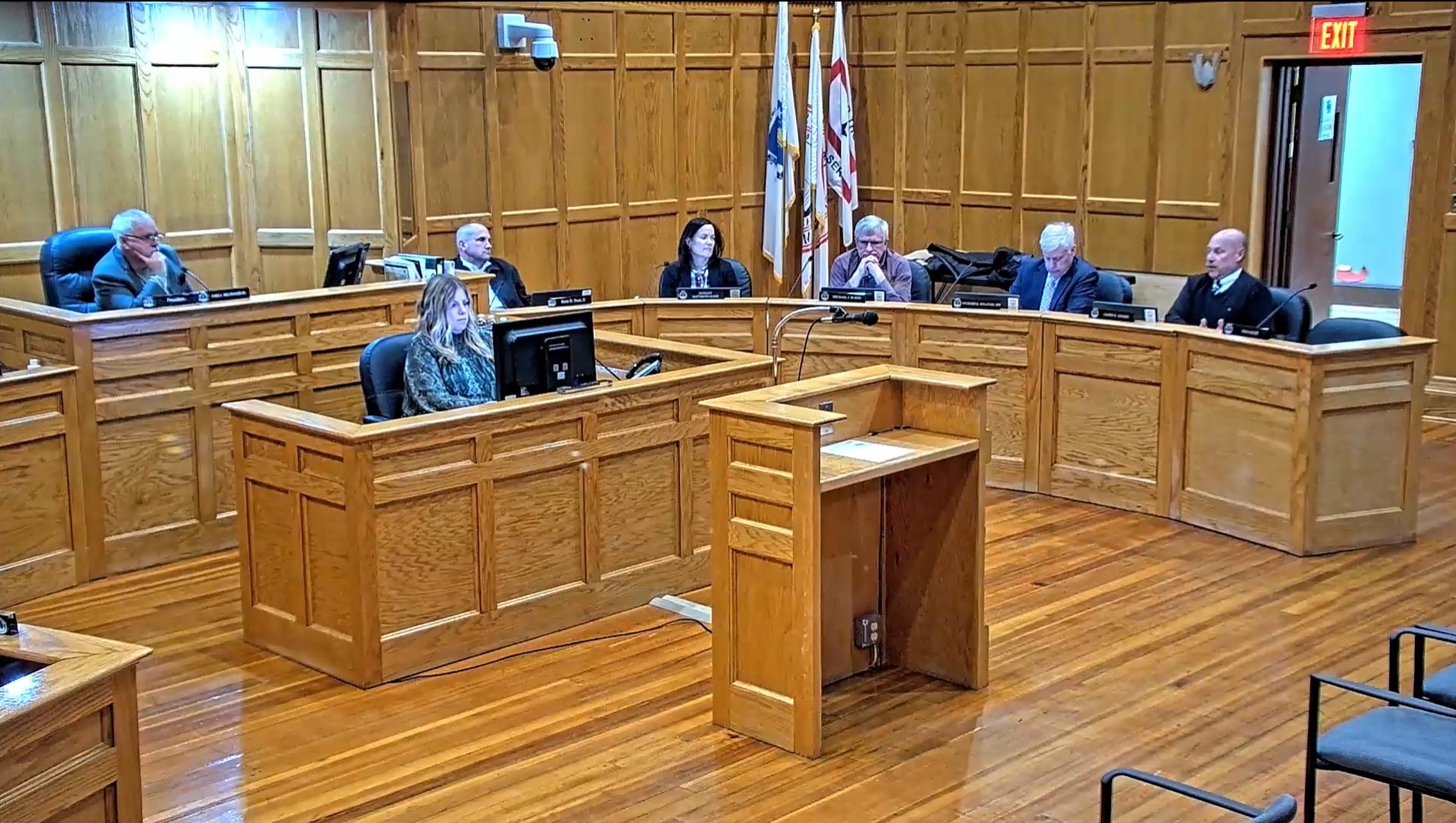

Councilor James Adams, far right, discusses Mayor Michael McCabe’s decision to decline the City Council’s request for $3 million from free cash to offset taxes.

Photo credit: Westfield TV

WESTFIELD — Council President John Beltrandi III opened the special meeting on Dec. 9 at 5 p.m., noting that the only item on the agenda was a vote on the tax shift between residents and commercial property owners in the city.

The vote had been postponed from the Dec. 4 meeting in order to send a letter to Mayor Michael McCabe requesting up to $3 million in free cash to offset taxes, which he declined.

After a discussion on each recommendation, four votes were taken, with the City Council ultimately settling on a tax shift of 1.68, slightly favoring residents over last year’s rate of 1.65.

First to speak at the hearing was Councilor Cindy Harris. “Last year, I made a motion of 1.65 because things worked out. The mayor had given us some extra money, and it was beneficial to both commercial and residential to have that factor,” she said, referring to $1 million in free cash to offset taxes given by the mayor one year ago at the City Council’s request.

However, she said this year is far different. “We received no money; the residents were taxed, with waste management extraordinarily high. The fee for sewer went up, the fee for water went up in the last five months … If you look at 1.75 this year, the residents would pay $22 extra a month, and businesses would pay $115 a month.”

Harris said businesses can write off many expenses that residents cannot, including trash pickup, water, sewer, parking and equipment on a sliding scale, and in that way have an advantage as far as being able to mitigate the increases that would come to them.

“This is not resident versus commercial … I’m trying to do what is fair to citizens because of the extraordinary circumstances,” she said, before making a motion for the tax shift of 1.75.

Councilor Rick Sullivan then asked if the letter from McCabe could be read in part to the public. “The bottom line is that the mayor has decided to not use any free cash to try to mitigate any increase here,” he said, asking that the letter be incorporated into the minutes of the meeting.

In the letter, which Councilor Ralph Figy read at the meeting, the mayor said in response to the request to add another $1 million from free cash, he referred to discussions with his financial team in the spring with the city’s treasurer, assessor and auditor, who advised against adding free cash to the fiscal year 2026 budget.

“Against that backdrop, I still included $2 million of free cash into the FY26 budget, thereby reducing the taxpayer burden by $128 annually, according to Councilor Figy’s math. That means, the reduction to the taxpayer was addressed by my office and approved by City Council when the budget was deliberated during the appropriate time frame and passed in June 2025,” McCabe wrote, adding, “Any discussions about the use of free cash are only appropriate during the budget process. To do so now is untimely.”

After the meeting, Figy, who chairs the Finance Committee, said he understood the mayor’s reasoning, but did not agree with its timing. “I think the council now fully realizes that budget time has an impact at shift setting time,” he said.

During the continuing discussion at the meeting, Councilor Nicholas Morganelli Jr. asked if he could amend Harris’ motion on the tax shift factor. Beltrandi said he could.

“We heard from the Chamber of Commerce that visited here … a vote for a tax shift that sends a message to the business community that we are more business-friendly in essence will help the residential tax rate because we’re going to bring in more businesses here,” Morganelli said.

“We can’t do that if we raise the rate for businesses. 1.75 is far above many other municipalities in the state. A lot of them are close to where we are now — a lot of them are better than 1.65. I don’t want to pay any more taxes than I have to for my own home in Westfield, but I’m willing to play the cards … and vote for a tax shift that benefits businesses and allows businesses to thrive; not only survive, but thrive,” Morganelli added, before proposing the tax shift of 1.61 requested at the Dec. 4 hearing by Chamber Director Amanda Waterfield.

Councilor James Adams then made a motion to amend the shift to 1.65, the current rate.

“First of all, we’re in a no-win situation here with whatever we do. I think we fiscally did this correctly when we did the budget. Next year, we should probably just cut it $3 million and let the mayor come to us to fill that back with free cash. That’s probably how we should have [done] it, but I think we were doing the right thing because we didn’t know what the free cash was. We’ve always used free cash to get the residents a break … we’ve done it every year that I’ve been here,” Adams said.

“I think it’s foolish that we have to do this when we have no development director. We’re trying to sell the city … I don’t agree with what the mayor’s doing … He tried to put a person in there that didn’t last very long. So I’m not sure if he’s trying to sell the city or if he’s trying to do it himself. I don’t know what he’s trying to do. So we are handcuffed here, no matter what we do. So I’d like to go to the middle of the road and go 1.65 to keep it even for the businesses and for the people. I’d love to give the people a break, but if we do that, we’re hammering the businesses. Without a community development director, we’re not gonna have a business to come into town,” Adams added.

“I’ll support the 1.65, and I appreciate the councilor’s comments about cutting the budget by $3 million next year. That is really the purpose of the motion I made back in June, which was to take $1 million out of engineering last year … that would have, at this point, had the mayor put $1 million worth of free cash back into that account to make it whole,” said Sullivan.

“We [the council] ultimately have the financial purse strings as long as you pull them at the right times because of the strong council form of government that we have. So it’s just when those levers get pulled. So I would encourage people to pull those levers next June when the budget is ready to be prepared,” he added. Sullivan is the only outgoing member of the City Council after losing the at large election.

Sullivan also talked about the list of the top 10 taxpayers, which the assessor supplied to the council by request. “I think seven of those either came in or did expansions back when I was mayor, and the other three were here before I was here as mayor. That shows you that there really hasn’t been any significant growth, particularly at the top of the taxpayer list. And just for additional comment, most of those people all came in with tax incentive agreements that are now paying full freight,” he said, thanking the assessor for the information.

“There has got to be a new growth strategy because we are out of whack between the residential burden and industrial and commercial, we’ve let that get out of whack. And so there needs to be some work done on that,” Sullivan said, adding that while he totally appreciates Harris’ consistent voice in favor of the residents, he would support the 1.65.

Harris said at a tax shift of 1.65, commercial rates will go up $71 a month, and residents’ rates will increase by $32 a month.

Councilor Karen Fanion said she appreciated the comments made for the 1.65 shift. “However, the comments that were previously made that this is an unprecedented year with unprecedented circumstances with fees going up for our residents on solid waste and the water, I think that we do have to give the residents more of a break than we have to for the commercial. I’m disappointed that the mayor did not give us any free cash,” she said, adding that if he had, she’d be more inclined to support the 1.65 to 1.66 range.

“Free cash has been given several times in the past years. I went back 10 years and looked at the amounts of free cash that were given. There was $2 million, sometimes $1.5 million, $1 million. So it’s disappointing that we aren’t using some of the $13 million that we do have in free cash to help out the tax rate, and that would help the businesses and the residents,” Fanion said, before making a motion for a tax shift of 1.74.

Beltrandi then asked for votes on the amendments, beginning with the latest one of 1.74 proposed by Fanion. The amendment for 1.74 failed 4-7, with Michael Burns, Karen Fanion, Cindy Harris and Brent Bean voting in favor. Kristen Mello and Dan Allie were absent for the special meeting.

The next vote was for the tax shift of 1.65, proposed by Adams, which also failed 5-6, with Figy, Bridget Matthews-Kane, Morganelli, Sullivan and Adams voting in favor.

Morganelli’s motion for a tax shift of 1.61 failed 10-1, with his sole vote in support.

Before voting on the original motion made by Harris, Councilor William Onyski proposed as an amendment a tax shift of 1.68. Harris said at 1.68, residents would pay $29 extra a month, and business/commercial would pay $85 extra a month.

The tax shift of 1.68 passed 8-3, with all but Burns, Fanion and Harris in support. A motion was then made and passed unanimously to set the residential tax factor at 0.8599.