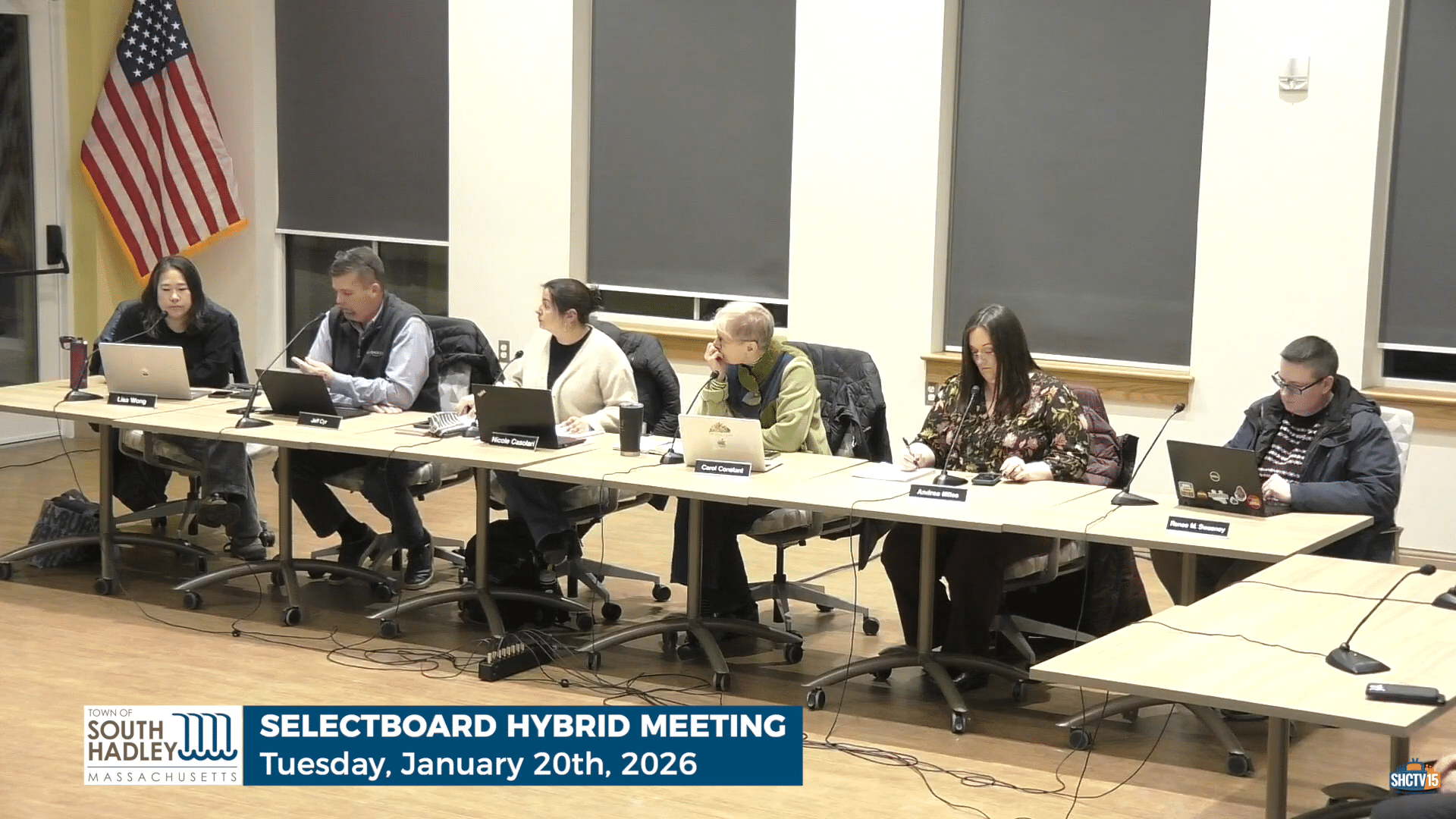

Town Administrator Lisa Wong (left) and the Selectboard discuss the town budget and potential solutions

Photo credit: SHCTV15

SOUTH HADLEY — With the Budget Task Force set to give their report on Feb. 9, the Selectboard discussed the possibility of hosting a Special Town Meeting to determine solutions regarding tax override options.

For the past few months, the town of South Hadley has discussed potential budget deficits and complications due to increasing costs, such as health insurance.

Town Administrator Lisa Wong gave an update to the Selectboard on Jan. 20 about the fiscal year 2026 budget. She also provided a preview of the FY27 budget.

For the FY27 operating budget, a level service budget, $67.7 million will yield a budget deficit of about $3.5 million, largely due to a $1.7 million increase in health insurance. There is also a $1.7 million increase needed for the school budget to offset grant losses.

Wong said the School Department could see a $1.5 million reduction, which would lead to cuts to three administration positions, 20 student-facing positions, sports, extracurricular activities, transportation options and some electives at the middle and high school.

In her presentation, Wong said they are projecting to have the budget cut by $1 million. Those cuts would force the town to close Gaylord Library, she said.

The reduction would also impact the Senior Center and Town Hall. Both would have to reduce staff, causing both buildings to have to close on Fridays. There could also be a reduction to health and safety inspections and a reduction to staff in the Police Department and Department of Public Works. The spray parks may also close.

To balance the budget, Wong said the town is looking to increase the local receipts by $400,000. The town would only contribute $300,000, instead of $500,000, to Other Post-Employment Benefits. The town may also use $200,000 in free cash on top of what the town has already been using.

The Budget Task Force, after meeting for months, is reviewing the need for a potential override and will produce a report by Feb. 9. They have hosted three listening sessions with the public and produced a community survey that has garnered thousands of responses.

There will be a multi-board meeting on Feb. 10 to discuss the Budget Task Force report. The boards will also discuss potentially hosting a Special Town Meeting for Feb. 25 to discuss the budget, problems and potential solutions.

Readers can find more information and past meetings at southhadley.org.

The presentation also included override options that the town and Budget Task Force are reviewing. “These are far from being set in stone,” Wong stated.

The task force looked at raising the tax levy by $3 million, $6 million or $9 million, which is based on what the town needed to level service the budget for a five-year projection. If the tax levy limit is raised by $3 million, the average single-family would see a $40-per-month raise to their taxes.

Selectboard member Andrea Miles, who also serves on the Budget Task Force, said she has “so much concern” with the $3 million tax levy being an option at all because it still results in “devastating cuts that we’re trying to avoid.”

The $6 million option includes raising the tax levy by $2 million over three years. If the town went this route, the average single family would see a $27 increase per month to their tax bills in years one, two and three.

This option would limit cuts between FY27 and FY29. There would be an estimated $1 million deficit in FY30 and a $3.4 million deficit in FY31. Schools would be funded $1 million below level-funding.

Wong said her recommendation is raising the tax levy by $2.5 million in year one, $2 million in years two through four and $500,000 in the final year.

If this occurred, single families would experience a tax increase of $33 per month in year one, $28 per month in years two through four and $8 per month in year five.

This option would limit cuts from FY27 to FY30. There would also be an estimated $1 million deficit in FY31, and schools would be at level funding with a 3% increase per year.

Wong said the Budget Task Force website has a calculator where residents can estimate what their impacts would be based on what their home value is.

Nothing was finalized at the meeting. Future updates and meetings will be covered by Reminder Publishing.