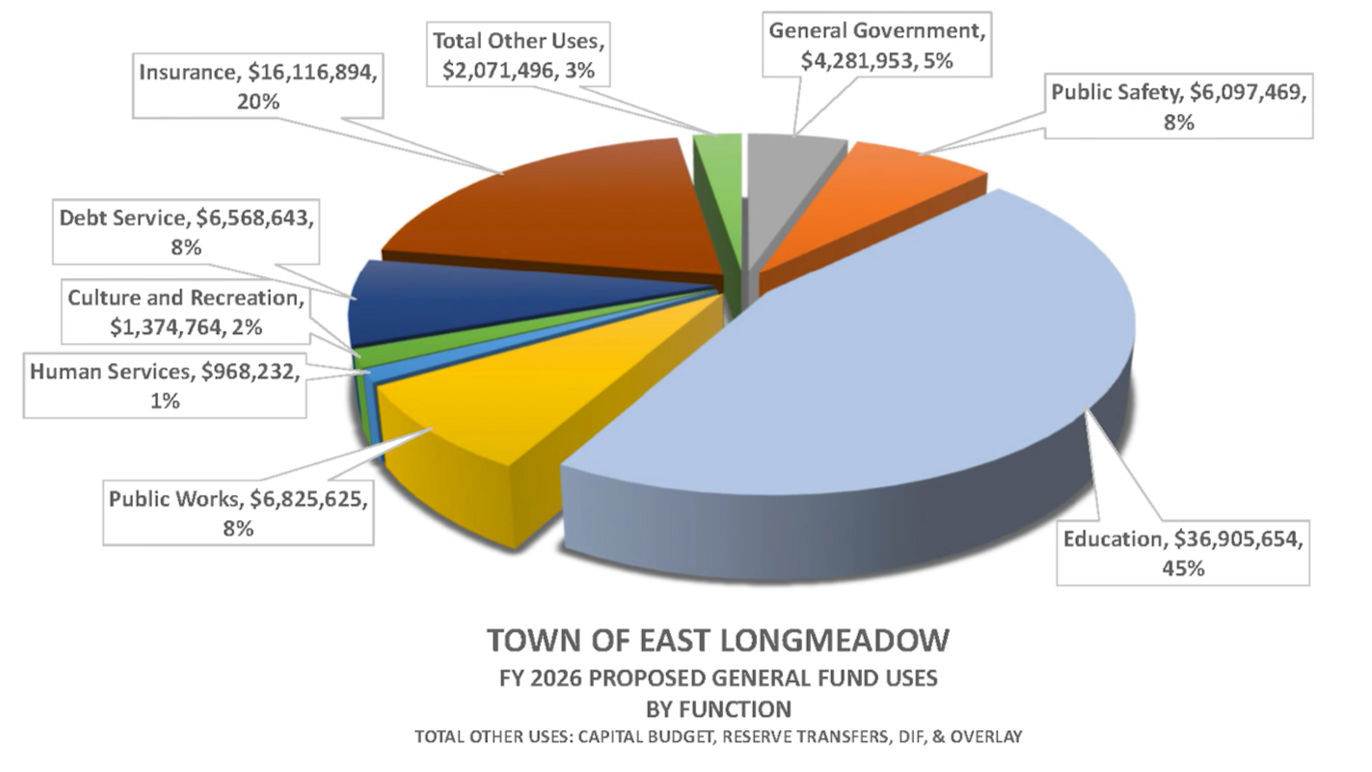

A pie chart depicts East Longmeadow’s fiscal year 2026 expenses, with the largest share going to the School Department, followed by insurance costs.

Photo Credit: ELCAT

EAST LONGMEADOW — The Finance Oversight Committee began its work on April 2, combing through the town’s draft budget for fiscal year 2026.

The committee, appointed by the Town Council president, performs the arduous task of reviewing the budget line by line to find efficiencies that could be cut and areas that may have been overlooked in the budget process. This year, the committee includes Chair Jim Broderick, Dawn Starks, Rich Freccero, and Councilors Kathleen Hill and Anna Jones. Council President Connor O’Shea serves in an ex-officio capacity. Councilors Ralph Page, Marilyn Richards and Jim Leydon also attended the April 2 meeting.

Town Manager Tom Christensen reviewed the budget draft, which he described as “very conservative.” With a total of $79.13 million, the FY26 budget is nearly $7 million more than it was in FY25, an increase of 2.26%. Despite this, Christensen said the town departments were kept to level services, meaning they include no new personnel or initiatives. Increases in non-discretionary costs, such as retirement assessments and insurance rates, left the town with the ability to raise just $1 million for increases to its budget, without cutting into the excess levy capacity.

The excess levy capacity, the focus of much conversation at the meeting, is a gap between the budget and the maximum amount taxable under the law. In Massachusetts, it is 2.5% of the previous year’s levy, plus any new growth. Christensen explained that it acts as a cushion against unforeseen costs in a “volatile time.”

Broderick asked if the desire to maintain the excess levy capacity was a reaction to potential grant and funding cuts from the federal government. While that is one factor, Finance Director Kimberly Collins explained that, historically, the town has not raised taxes by the full 2.5% legally allowed. She said the amount included in this year’s budget will be baked into the funding formula for next year’s budget. Not using the full amount keeps tax rates below the legal maximum of $25 per $1,000 in value.

“I congratulate you on your restraint,” Broderick said, recognizing the challenge of keeping spending down. The estimated property tax rate for FY26 is $19.28 per $1,000 in value, $1.87 of which is debt related to the high school and natatorium projects.

Despite the best efforts of Christensen and Collins, just over $300,000 in excess levy capacity was needed to balance this year’s budget, leaving an excess capacity of $1.3 million. There was “nowhere else to go” in terms of cuts to make to a level service budget, Christensen said.

Christensen said much work has been done to “flatten that expense curve that got out of control after [COVID-19].” Moving forward, he said the town will need to find ways to boost revenue, as not much more can be trimmed from the expense side of the funding equation. The vast majority, 73%, of the town’s general fund comes from property taxes. The rest comes from state aid and local receipts.

While part of the Finance Oversight’s Committee’s job is to examine the budget for potential savings, Christensen said $1 million had already been trimmed from the initial town department requests. A substantial portion of that was from the School Department, which began its budgeting process needing an 8.57%, or $3.08 million, increase to reach a level service budget. As that figure was far out of the town’s capability, the School Committee approved a reduced increase of 5%, which was reached with a combination of School Choice revenue, deferred academic improvements, contractual bargaining and cutting positions. Still out of line with the town’s resources, the school budget increase was further reduced to 2.5%, which will result in an additional 14 positions being cut or otherwise going unfilled.

The Finance Oversight Committee will meet each Wednesday for five weeks before finalizing its recommendations to the council. The council will then conduct a public hearing on the budget, beginning May 13.