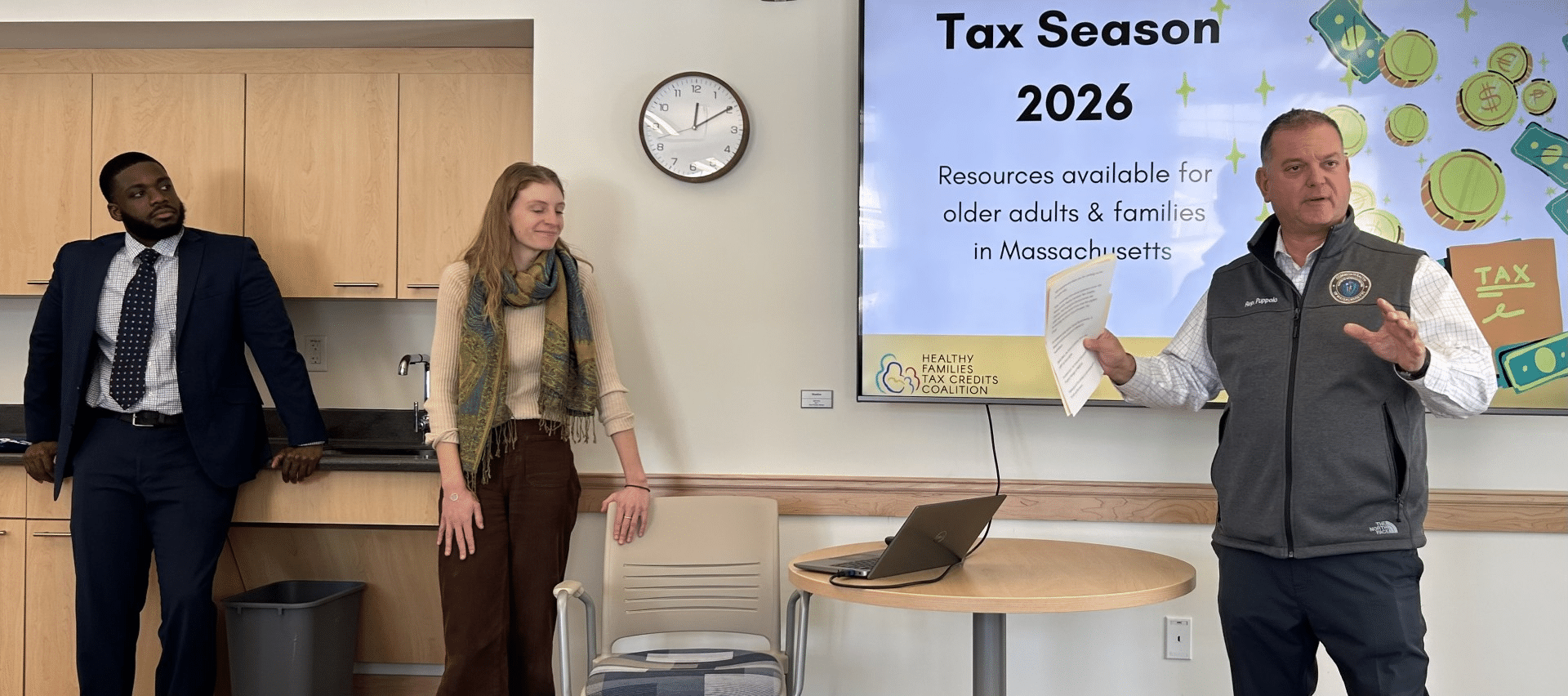

From left to right: Kwabena Ayim, Carley Ruemmele, state Rep. Angelo Puppolo.

Reminder Publishing submitted photo

WILBRAHAM — With tax season upon us, state Rep. Angelo Puppolo hosted an informational event to educate about tax credits that people might not know they’re eligible for at the Wilbraham Senior Center on Feb. 12. The event included a presentation from Healthy Families Tax Credits Coalition members Carley Ruemmele, Daniel Welch and Kwabena Ayim.

The coalition is led by Boston Medical Center and is a group of about 80 organizations across the state that share information about available tax credits to families. Since the start in 2015, the coalition has helped increase the earned income tax credit three times and advocated for investing state dollars into volunteer income tax assistance programs.

“This was a great opportunity to inform my constituents about the tax credits they may be eligible for,” Puppolo, a Springfield Democrat, said in a press release. “I enjoyed hearing questions from Wilbraham residents and hope they are able to use this information to make the most out of this year’s tax season.”

The presentation went through three major tax credit opportunities, the senior circuit breaker credit, the earned income tax credit and the child and family tax credit.

“It might sound a little bit intimidating, but really think of this as cash going back into your pockets,” Ruemmele said. “Cash that you are owed, and that you can claim on your tax form.”

The senior circuit breaker tax credit has a maximum credit amount for tax year 2025 of $2,820 and available to those who were 65 or older by Dec. 31, 2025. It is designed to offset high housing costs for adults and is based on the actual real estate taxes or rent paid on the Massachusetts residential property one may own or rent, and occupy as a principal residence.

For the senior circuit breaker credit, if the credit someone is owed exceeds the amount of the total tax payable for the year, the additional amount will be refunded without interest. The income limits to qualify are less than $75,000 for single filers, less than $112,000 for joint filers and less than $94,000 for heads of household.

Eligible residents can claim this credit by submitting a Schedule CB with their 2025 tax return. Additionally, local volunteer income tax assistance centers provide free support to help determine eligibility and complete filings. Centers can be found using the IRS VITA site locator tool.

The EITC is designed to support low- and moderate-income workers, which means an earned income is required to earn this credit, according to Ruemmele.

The amount for the credit is an equation based on income, the number of children you have and your marital status. Ruemmele said the child doesn’t need to be biological and taking care of a grandchild counts, but you, your spouse and qualifying child must have a valid social security number.

The income limits are $26,214 if you have no qualifying dependents, less than $57,554 with one child, less than $64,430 with two and less than $68,675 with three or more. On average in 2023, the average credit put back into pockets was around $900.

The child and family tax credit provides $440 for each qualifying dependent, including children under age 13, a dependent or spouse who is physically or mentally incapable of self-care and lives with the taxpayer, a dependent age 65 or older and a dependent with a disability.

This credit does not require an earned income and is immigrant inclusive so it can be earned universally as long as the filer has a qualifying dependent.

Ruemmele provided an example for this credit through a family with two children, ages 15 and 11, who also provide care to one of the parent’s 75-year-old mother. This filer would qualify for $880 under the child and family tax credit because of a child under the age of 13 and an older adult who qualifies as a dependent.

Walsh is the district coordinator at AARP and he said there are about 18 locations all over Western Massachusetts that are free to use. He encourages booking an appointment and that walk-ins aren’t accepted so that the most people possible can get their returns done each day.