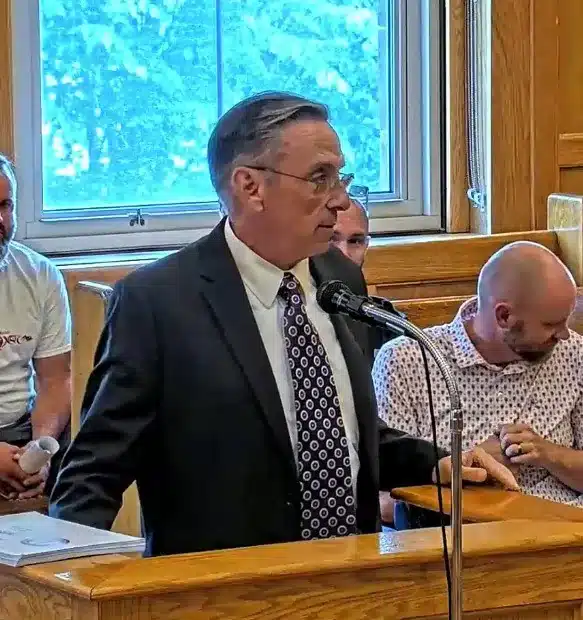

Westfield Mayor Michael McCabe presented the FY26 budget to the City Council on June 6.

Photo credit: Westfield Community TV

WESTFIELD — Mayor Michael McCabe presented the fiscal year 2026 budget of $163.8 million for review to the City Council at its meeting on June 5.

“This budget has been a difficult budget to prepare,” McCabe said, and specifically thanked City Council President John Beltrandi and

Finance Committee Chair Ralph Figy for helping sit in on some of the budget hearings.

“I came before you in March or April and we spoke briefly about issues this budget was going to face and a number of unexpected increases that were beyond the control of the city’s management staff or financial team to be able to foresee,” he said, listing special education increases of $1.1 million, transportation increases of $1.3 million, mandatory staff increases of just under a million, contractual obligations of $1.8 million, a health care increase of $5.8 million, utilities cost increase of 15% across the board and trash and recycling fees that had a $2.3 million deficit. He said there were also $5 million in inflationary cost increases.

McCabe said in FY25 there was also a tax decrease to residents. “When we used free cash last year to give a tax decrease to folks and offset the budget deficit … that came out to -1%,” he said, adding that all in all, costs were $17 million over the previous year’s budget.

He said last year the city used $5 million in free cash to balance the FY25 budget, and the funding is not available to do that again in FY26. Later he said $2 million in free cash was used to balance the FY26 budget. “Our budget looks like it’s going to come in on a free cash balance of 3%. The DOR recommends 5%. I’m not too worried about it, I think when the new free cash number comes in November, I think there will be more than 5% overall,” he said.

McCabe said there are no new personnel across the board, no vehicles across the board, and an appropriate level of services will be kept status quo. “There is no real decrease in services in FY26 over FY25, even though we’ve had this $17 million gap to close.”

McCabe said the city closed a couple of schools, specifically Fort Meadow, Abner Gibbs and Franklin Avenue, and added a state-of-the-art Westfield River Elementary School. He said the consolidation in elementary schools helped to reduce costs in personnel and services.

Without getting into details about the levy limit and levy ceiling and their interrelatedness to city financing, which he said currently stands at $12.5 million in excess capacity, he said, “I remember sitting through council meetings in the cheap seats over the last 15 years, and I remember hearing that it was a really good thing if we had excess capacity built into our levy. As as it turns out, the state doesn’t want to see excess capacity in our levy, because when you go to them for help, they say ‘spend your own money.’”

McCabe said the city expected help from increases in Chapter 70, Chapter 74 and Chapter 90, the state’s funding sources, but “there really was not a lot of help at all.” He said unrestricted government aid went up $120,000, “which isn’t really an awful lot of anything.”

In his letter to the council, McCabe said the plan is to spend $3.5 million of the excess capacity in FY26. “By doing so, better positions to receive state funding, especially Chapter 70 and Chapter 74. This also means we will return to using only minimal free cash this year, and hopefully no free cash in FY27.”

McCabe suggested in reviewing the budget, that councilors go to the mayor’s recap in the beginning of the budget for a thumbnail read. He also suggested looking at pages 194-214, the appendices in the back of the budget, “they will walk you through all the items I just talked about.”

“If you’re looking at it, you’ll see how we tried to balance the budget. There are only three ways to balance the budget; through new growth, you can pick up through some local receipts — this year we’re going to get an advantage of a local receipt that is significantly higher than it’s been before, and you can do it through taxation and excess capacity monetary use,” McCabe said, referring to the additional $2 million that will be generated by the increase in the trash collection fee.

He said without new growth, the only thing left to do is tax at 2.5% and then tax the excess capacity at 2.5%, which added to the $2 million in free cash and $2 million increase in local revenues was how the budget was balanced.

He said the mayor’s cut sheet shows the cuts made to city departments of $3.2 million, It also shows a positive offset of $3.5 million in the insurance category.

He said the School Department budget was cut by $5.2 million, but saw a 4% increase over FY25. “It’s important to realize that a 4% increase, while greater than the city budget, is a necessary increase. Unfunded mandates are crushing the School Department budget and crushing the taxpayer,” McCabe said.

“I’ve tried to address it with the governor. The problem lies within the Legislature — the body that creates the rule and then they don’t fulfill the rule that they create. They’re the only ones that can fix that rule. If you have any influence with your state legislators, I would urge you to ask them to fund where they say they’re supposed to fund,” he added.

McCabe gave two examples of funding disparities from the state. He said the Massachusetts School Building Authority is supposed to be funded at 80 percent. The Westfield River Elementary School cost $16 million, and the city was reimbursed $32 million, roughly 50%. He said to be fair, the MSBA created their own exemptions. ”If they exempt pieces of the puzzle, they can still say that they’re funding 80% of the non-exempted pieces of the puzzle,” he said.

The other exemption was the funding of Circuit Breaker for special education expenses. McCabe said they are supposed to be funding at 75%, but are instead funding at 44%. “That little difference is worth about $1.5 million,” he said.

Before running off to the Westfield Technical Academy graduation, McCabe thanked Auditor Vicki Moro, who created the 214 page document, Assessor Ashlie Brown, Personnel Director Anne Larkham, Treasurer/Collector Matt Barnes, School Business Manager Shannon Barry, Solicitor Shanna Reed, City Councilors Ralph Figy and President John Beltrandi and Superintendent Stefan Czaporowski for all the help they have been in working collaboratively on the budget. “I greatly appreciate their assistance,” he said.

The budget was sent by the Council to the Finance Committee for review. Finance Committee reviews were scheduled for June 9, 10, 11, 16 and 17 beginning at 5:30 p.m. in various rooms in City Hall.

A financial overview and public hearing for the budget is scheduled for June 23 at 6 p.m. in Room 207, City Council Chambers. On June 24, also in Room 207, city councilors will review the entire budget and make recommendations. On June 30, councilors will vote on the budget.

The schedule of meetings is posted on the city website at cityofwestfield.org. The budget is also posted on the website under departments, auditor, Fiscal Year 2026.